For Q2, revenue climbed from $8.76 billion to $9.50 billion, beating last year’s $9.1 billion. Earnings per share improved to $0.50, up from $0.34 the previous quarter but still below the $0.93 per share from the prior year. Despite a mixed financial picture, Guggenheim Partners reiterated its "Neutral" rating on Starbucks, while lifting its price target from $79.00 to $90.00, reflecting cautious optimism.

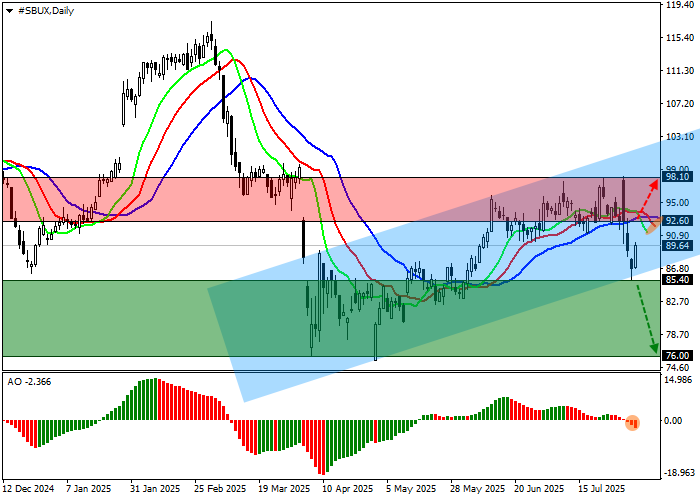

Support and Resistance Levels

On the daily chart, SBUX remains in a downward trend, trading just above support along the channel’s lower boundary between $100.00 and $86.00.

- Resistance: $92.60, $98.10

- Support: $85.40, $76.00

Technical indicators hold a bearish bias: the EMA range on the Alligator indicator remains narrow, while the AO histogram continues to generate corrective bars in the sell zone.

Trading Scenarios

- Short setup: Sell stop orders may be considered on a break below $85.40, targeting $76.00. Recommended stop-loss: $90.00. Holding period: 7+ days.

- Long setup: Buy stop orders may be initiated on a move above $92.60, targeting $98.10. Recommended stop-loss: $89.00.

Starbucks stock support and resistance levels

Starbucks stock support and resistance levels Key Levels for This Week

- $76.00

- $85.40

- $92.60

- $98.10