Analyst Altcoin Sherpa noted that Bitcoin’s market structure remains strong after the latest rally but warned traders to stay cautious as the price nears resistance. Short-term support sits near $119,909, while a deeper pullback could bring BTC down to $116,000. A clear breakout above $123,259 would likely pave the way toward $125,550 and even $128,000.

I still think that $BTC looks pretty strong but prudent to be a bit careful around this region. I'm still long but cut all perp positions rn other than a higher time frame $BNB long. still bullish but wouldn't be surprised to see some short term pullback pic.twitter.com/55kljXMjME

— Altcoin Sherpa (@AltcoinSherpa) October 4, 2025

“Uptober”: Bitcoin’s Best Month Strikes Again

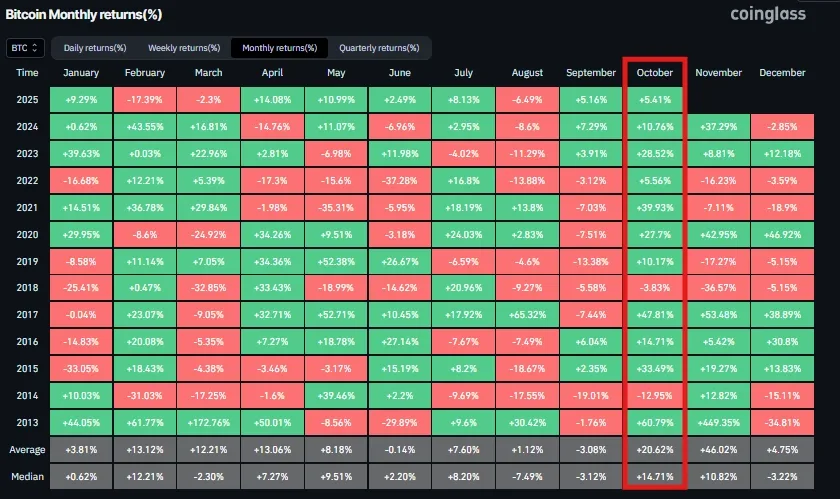

October has long been Bitcoin’s lucky month. Over the past 11 years, BTC has posted gains almost every October — with an average return of 20.6%. That’s why traders call it “Uptober.”

The fourth quarter is also historically Bitcoin’s strongest stretch. Average Q4 gains have reached nearly 80%, highlighting the market’s tendency to rally into year-end. If the pattern holds in 2025, BTC could soon break into new record territory.

On the daily chart, Bitcoin remains well above key moving averages: the 50-day at $113,743, the 100-day at $114,460, and the 200-day at $105,521. The $118,000 zone — once resistance — has turned into a strong support base. Momentum indicators also back the bulls: MACD (12,26,9) is at 1,125, sitting comfortably above the 517 signal line, suggesting the uptrend still has room to run.

Institutions Step In: ETFs, Derivatives, and Inflows Surge

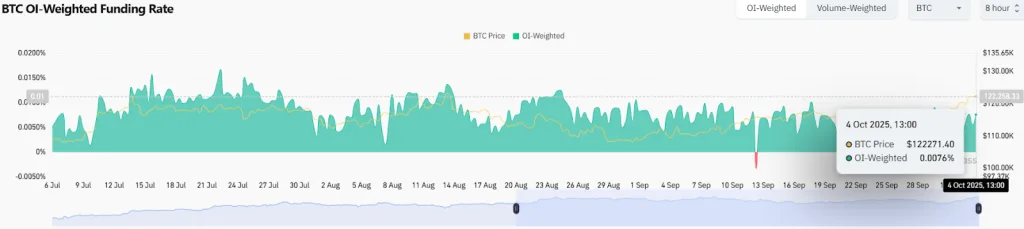

Derivatives activity is heating up across major exchanges. Open interest has climbed 1.54% to $89.88 billion, while daily trading volume jumped 17.4% to $114.72 billion. The funding rate at 0.0076% signals a balanced market between long and short positions. In the last 24 hours, total liquidations hit $202.54 million — with shorts taking the bigger hit at $151.47 million.

Institutional inflows are also back in force. Spot Bitcoin ETFs saw $3.24 billion in net inflows this week — the biggest since mid-September — fully reversing last week’s $902.5 million outflow. Growing demand from U.S. investors is reflected in the Coinbase Premium Gap, which widened by $113 compared with other exchanges.

Part of the renewed interest stems from the U.S. government shutdown, which delayed key macroeconomic data like the September jobs report. That uncertainty has pushed some investors toward Bitcoin and other digital assets as short-term hedges.

Bottom line: Bitcoin’s uptrend rests on solid institutional inflows, strong technicals, and steady trading volume. If these factors hold through October and into Q4, BTC could easily retest — or surpass — its all-time highs. Many analysts believe this “Uptober” rally might mark a key turning point for the next major crypto cycle.