Experts note that during a bilateral meeting held earlier this week between Prime Minister Sanae Takaichi and Bank of Japan Governor Kazuo Ueda, the sides reached a mutual understanding on ways to curb inflation while sustaining economic growth. As a result, a corresponding shift in monetary policy could follow as early as the regulator’s next meeting. Meanwhile, in January, exports rose sharply from 5.1% to 16.8%, while imports declined from 5.2% to –2.5%, causing the trade balance to narrow from a surplus of 113.5 billion yen to –1.152 trillion yen, better than the forecast of –2.142 trillion yen.

The US dollar is regaining previously lost ground and is trading around 97.60 on the USDX, rebounding from a recent low of 96.30. Investor focus remains on macroeconomic data and the minutes of the latest Federal Reserve meeting, at which interest rates were left unchanged in the 3.50–3.75% range after three consecutive 25-basis-point cuts. Officials pointed to an improved economic growth outlook and a recovering labor market, although Christopher Waller and Steven Miran argued in favor of an additional 25-basis-point rate cut. The statement also removed references to elevated employment risks that had appeared in the previous three releases. In addition, the report noted that some policymakers could support a more hawkish stance in March if consumer inflation remains above the 2.0% target. Although inflation is slowing, it currently stands at 2.4%, effectively ruling out near-term monetary easing. According to the CME FedWatch Tool, the probability that borrowing costs will remain in the 3.50–3.75% range in March has reached 94.1%. The currency is also supported by macroeconomic data showing industrial production strengthening to an annual high of 0.7% in January, driven by increased output in utilities and manufacturing. Orders for business equipment rose by 0.6% following a revised 0.8% increase the previous month, exceeding forecasts and signaling resilient fixed investment amid reduced trade policy uncertainty. Construction activity also accelerated, with housing starts rising 6.2% to an annualized pace of 1.40 million, while building permits climbed to a March peak of 1.45 million.

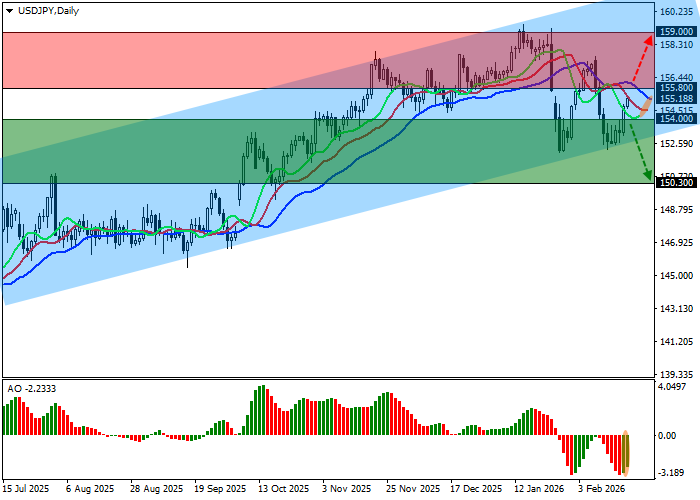

Support and Resistance Levels

On the daily chart, the instrument is attempting to rebound from the support line of a long-term ascending channel with boundaries at 161.00–152.50.

Technical indicators are weakening the sell signal: the fast EMAs of the Alligator indicator are approaching the signal line, while the AO histogram is forming corrective bars in negative territory.

Resistance levels: 155.80, 159.00.

Support levels: 154.00, 150.30.

Trading Scenarios and USD/JPY Forecast

Short positions can be opened after a decline and a firm break below 154.00, with a target at 150.30 and a stop-loss at 155.50. Time horizon: 7 days or more.

Long positions can be opened after a rise and consolidation above 155.80, with a target at 159.00 and a stop-loss at 154.00.

Scenario

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry point | 153.95 |

| Take Profit | 150.30 |

| Stop Loss | 155.50 |

| Key levels | 150.30, 154.00, 155.80, 159.00 |

Alternative Scenario

| Recommendation | BUY STOP |

| Entry point | 155.85 |

| Take Profit | 159.00 |

| Stop Loss | 154.00 |

| Key levels | 150.30, 154.00, 155.80, 159.00 |