August is once again proving difficult for Bitcoin. With a decline of 6.5%, the leading cryptocurrency fits an old pattern: the summer month has long been one of the weakest periods in Bitcoin’s calendar. But the current losses are about more than seasonality. A billion-dollar whale sale, ETF outflows, and overheated futures markets are reinforcing the downward move. The key question for crypto investors: is this just the typical summer dip — or could a deeper pullback follow in September?

Bitcoin in August: Historical Pattern Confirmed

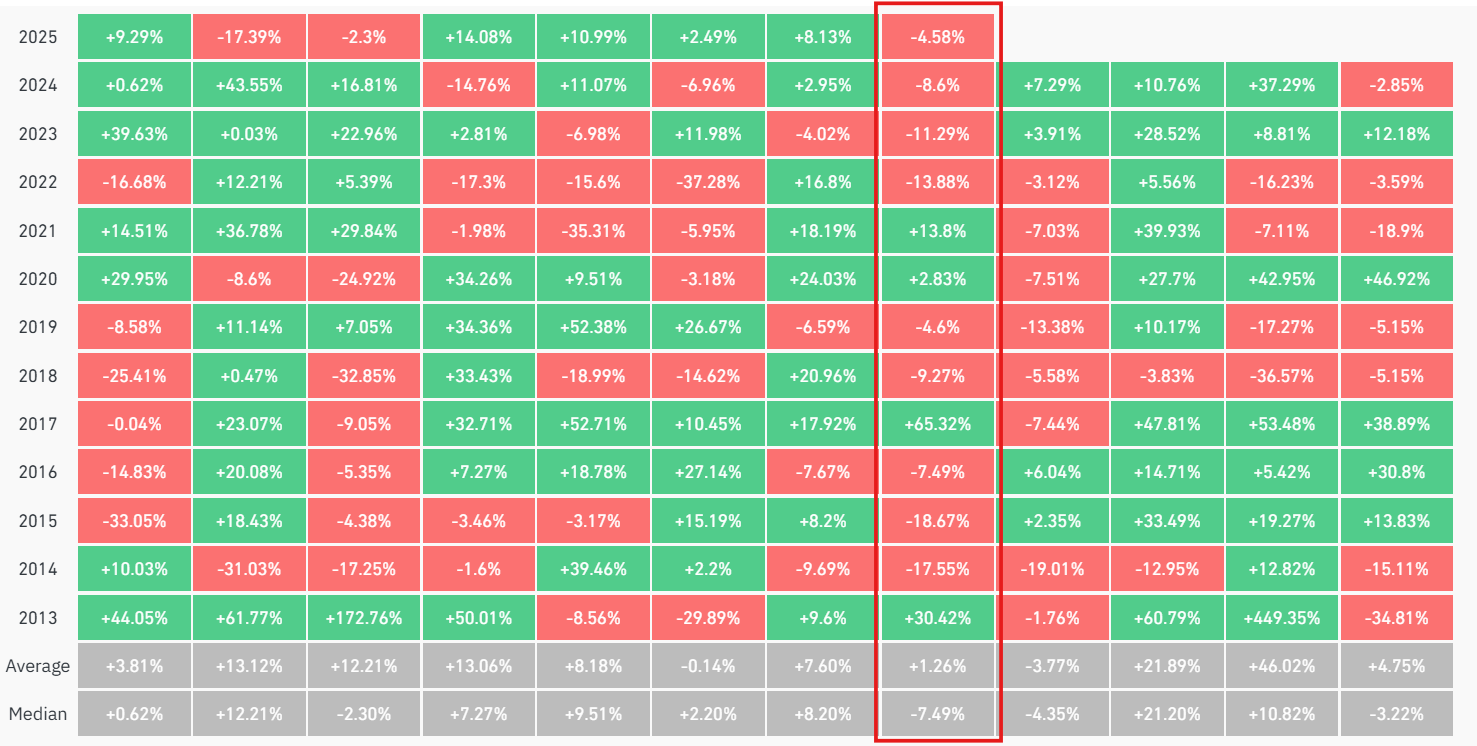

Over the past 30 days, BTC has lost about 6.5% in value. What looks like an outsized correction at first glance follows a historical pattern: statistically, August is one of Bitcoin’s weakest months. In recent years, August returns for BTC have consistently been negative.

It actually started well for Bitcoin in August, with “digital gold” even hitting an all-time high above $124,000 in mid-month. The subsequent correction is what’s playing out now.

Are Whales Becoming a Problem for Bitcoin?

The latest sell-off was triggered by a whale who offloaded 24,000 BTC, worth about $2.7 billion. A large share of the proceeds was rotated into Ethereum: more than 416,000 ETH (around $2 billion) moved to a new wallet.

The sale sparked brief market panic. Result: $225 million in long positions were liquidated, primarily among traders who had bet on rising prices in the days prior.

This price action ties into a broader structural issue. According to analyst Willy Woo, a large portion of the Bitcoin supply sits with OG whales who built positions in 2011. They acquired coins under $10 and can sell today at very high profit margins.

Why is BTC moving up so slowly this cycle?

— Willy Woo (@woonomic) August 24, 2025

BTC supply is concentrated around OG whales who peaked their holdings in 2011 (orange and dark orange).

They bought their BTC at $10 or lower. It takes $110k+ of new capital to absorb each BTC they sell. pic.twitter.com/7CbWXsvX2l

“It takes more than $110,000 in new capital to absorb each BTC they sell,” Woo said. The market suffers from this supply concentration because these whales are highly price-sensitive.

ETFs and Futures Reinforce the Downtrend

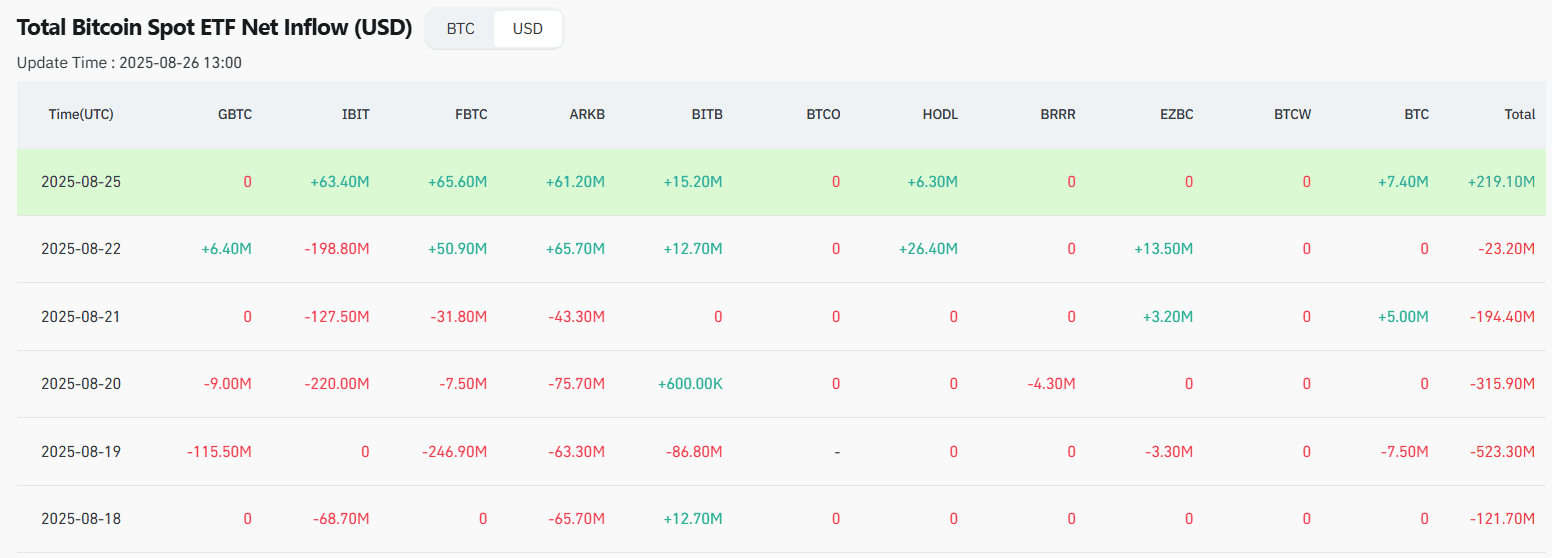

While whales are selling, institutional support — aside from Strategy’s weekly purchases — is limited. U.S. spot Bitcoin ETFs saw about $1.17 billion in outflows last week, signaling diminished confidence in the near-term outlook.

Futures data shows open interest reached a yearly high of $1.02 trillion just before the drop. Average funding rates fell 54% month over month to just 0.0046%.

$75,000: Is the Bitcoin Bull Run Over?

The correction has prompted bearish calls from long-time critics like Peter Schiff, who expects a move to $75,000 — a roughly 31% decline from current levels and a drawdown that has already occurred earlier this year. Such retracements are not unusual for Bitcoin even in bull markets.

PlanB disagrees. The trader wrote on X: “Bitcoin is still in a bull market, [there are] no bear signs.” His view is based on “Bitcoin market cycles” that suggest an ongoing breakout; historically, however, PlanB has been off the mark at times.

Bitcoin $110k .. still in a bull market 🔴 .. no bear signs pic.twitter.com/M2zgg9GqtE

— PlanB (@100trillionUSD) August 26, 2025

Outlook: Rate Cut and Q4 Offer Support

Despite current weakness, there are positives. Historically, Bitcoin performs strongly in Q4. If the Federal Reserve cuts rates in September — CME FedWatch places the probability at 86% — risk assets like Bitcoin could get an additional boost.

Smaller wallets continue to accumulate while larger addresses sell. The shake-out could lead to a healthier supply structure over the medium term, potentially setting the stage for the next upward move.