Republicans, who hold a majority in Congress, attempted to pass a temporary bill to maintain current funding levels until the end of November, but fell short by about ten votes. As a result, around 750,000 employees will be sent on unpaid leave, with some likely to face permanent layoffs. The shutdown will weigh on the economy and businesses, as markets will lack timely statistical updates, complicating investment decisions. Moreover, the Federal Reserve will not be able to assess key labor market data, forcing policymakers to adopt a more cautious stance on monetary adjustments.

In this environment, the euro remains relatively more attractive for investment, as the region’s economy shows greater resilience. Data released today confirmed this: the annual consumer price index for September rose to 2.2%, while the core index held steady at 2.3%, in line with forecasts. This reinforced ECB President Christine Lagarde’s view that inflation risks in the eurozone remain contained. In Germany, however, inflation hit its highest level since February, rising from 2.2% to 2.4% year-over-year, above the 2.3% estimate. While this may slightly affect the broader eurozone trend, it is unlikely to prompt another rate cut this year.

Support and Resistance Levels

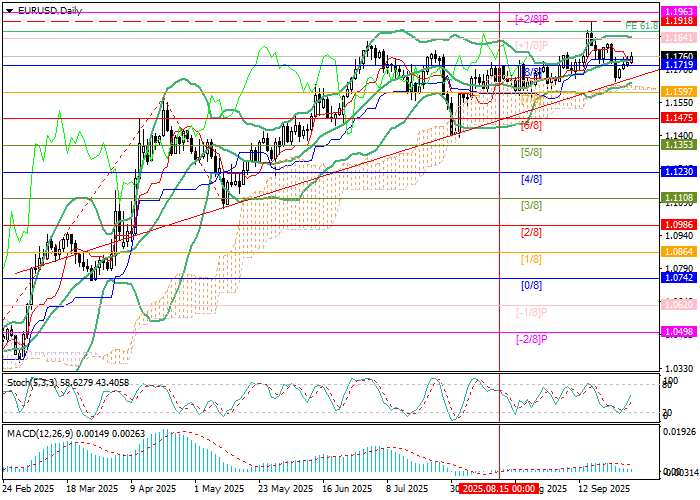

The pair is trying to consolidate above the middle Bollinger Band at 1.1750, targeting 1.1918 (near yearly highs) and 1.2085 (Murray level [6/8], H4). Conversely, a breakdown below 1.1597 (Murray level [7/8]) could push the price toward 1.1475 (Murray level [6/8]) and 1.1353 (Murray level [5/8]).

Technical indicators point to a bullish outlook: Bollinger Bands and Stochastic are turning upward, while the MACD histogram remains steady in the positive zone.

Resistance levels: 1.1750, 1.1918, 1.2085.

Support levels: 1.1597, 1.1475, 1.1353.

Trading Scenarios and EUR/USD Forecast

Long positions may be opened above 1.1750, targeting 1.1918 and 1.2085, with a stop loss at 1.1660. Implementation timeframe: 5–7 days.

Short positions may be considered below 1.1597, targeting 1.1475 and 1.1353, with a stop loss at 1.1680.

Scenario

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1755 |

| Take Profit | 1.1918, 1.2085 |

| Stop Loss | 1.1660 |

| Key Levels | 1.1353, 1.1475, 1.1597, 1.1750, 1.1918, 1.2085 |

Alternative Scenario

| Recommendation | SELL STOP |

| Entry Point | 1.1597 |

| Take Profit | 1.1475, 1.1353 |

| Stop Loss | 1.1680 |

| Key Levels | 1.1353, 1.1475, 1.1597, 1.1750, 1.1918, 1.2085 |