Later today at 09:55 (GMT+2), Germany will release labor market and inflation data. Forecasts suggest the unemployment rate will remain at 6.3%, with the number of unemployed potentially rising by 7K after falling by 9K the previous month. Meanwhile, CPI is expected to tick up from 2.2% to 2.3% YoY, while the core index could rise from 2.1% to 2.2%. On a monthly basis, CPI is projected to stay flat at 0.1%. Overall, the eurozone economy shows relative stability, with inflation holding near the ECB’s 2% target. The central bank is largely seen as having completed its rate-cutting cycle, though markets are still pricing in the possibility of one final 25bps cut before year-end. Final eurozone inflation figures are due tomorrow at 11:00 (GMT+2), with expectations for CPI to move from 2.0% to 2.2% and core inflation to hold steady at 2.3%.

ECB Chief Economist Philip Lane recently stated that the risk of inflation significantly overshooting or slowing down remains limited. He emphasized “solid fundamentals” supporting demand recovery, including fiscal measures, low unemployment, and rising real incomes, concluding that the ECB currently sees the inflation outlook as “fairly favorable.”

On the U.S. side, the spotlight remains on labor market data — a key driver for potential Fed policy easing. At 16:00 (GMT+2), the August JOLTS job openings report is due, with expectations for a modest slowdown from 7.181M to 7.100M. Tomorrow at 14:15 (GMT+2), the ADP employment report is projected to show a decline from 54K to 50K private sector jobs. The official September Nonfarm Payrolls report will be released Friday at 14:30 (GMT+2), with analysts forecasting around 50K new jobs — more than double the 22K seen in August. Average hourly earnings are expected to remain steady at 0.3% MoM and 3.7% YoY, while the unemployment rate should hold at 4.3%.

Support and Resistance Levels

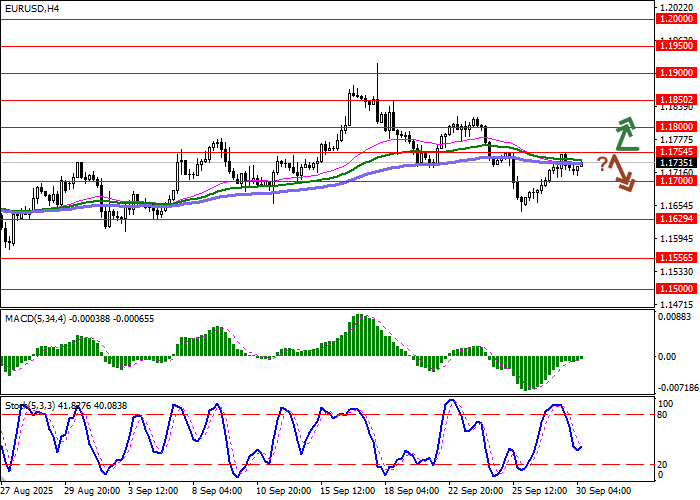

Bollinger Bands on the daily chart show flat dynamics with narrowing ranges, reflecting a mixed short-term outlook. MACD is attempting to turn higher, forming a new buy signal as the histogram approaches above the signal line. Stochastic is climbing confidently away from the “20” oversold threshold, suggesting near-term upside potential for the euro.

Resistance levels: 1.1754, 1.1800, 1.1850, 1.1900.

Support levels: 1.1700, 1.1629, 1.1556, 1.1500.

Trading Scenarios and EUR/USD Outlook

Long positions can be considered after a breakout above 1.1754, targeting 1.1850 with a stop-loss at 1.1700. Timeframe: 1–2 days.

Short positions may be opened if the price rebounds from 1.1754 resistance and breaks below 1.1700, with a target at 1.1600 and a stop-loss at 1.1754.

Scenario

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1755 |

| Take Profit | 1.1850 |

| Stop Loss | 1.1700 |

| Key Levels | 1.1500, 1.1556, 1.1629, 1.1700, 1.1754, 1.1800, 1.1850, 1.1900 |

Alternative Scenario

| Recommendation | SELL STOP |

| Entry Point | 1.1700 |

| Take Profit | 1.1600 |

| Stop Loss | 1.1754 |

| Key Levels | 1.1500, 1.1556, 1.1629, 1.1700, 1.1754, 1.1800, 1.1850, 1.1900 |