Interestingly, the British currency almost completely ignored weak macroeconomic data released last Friday. The S&P Global Services PMI for September dropped sharply from 53.6 to 50.8, well below the analysts’ forecast of 51.9. The Composite PMI also declined from 53.0 to 50.1 versus preliminary estimates of 51.0. Today at 10:30 (GMT+2), S&P Global will release September construction sector data, expected to show a slight decrease from 45.5 points. At 19:30 (GMT+2), Bank of England Governor Andrew Bailey is scheduled to speak, possibly clarifying the prospects of lowering borrowing costs. During the September meeting, the regulator kept the interest rate unchanged at 4.00%, citing high inflation. As of August, the annual consumer price index stood at 3.8%, the highest since January 2024. On Friday, Bailey stated that economic stability can cause some parties to underestimate the importance of tracking future risks, emphasizing that the Bank continues to strengthen supervision and monitor potential events that could threaten financial stability. He added that he disagrees with claims that post-2008 financial regulations hindered productivity or investment growth, explaining that abandoning strict oversight could instead trigger new risks for the national economy.

Support and Resistance Levels

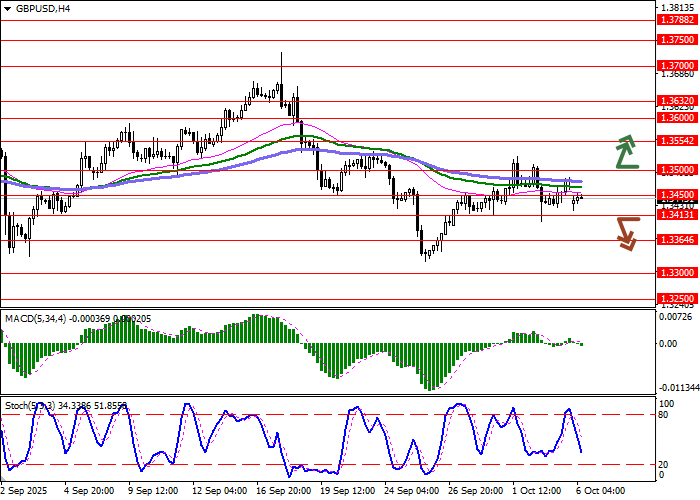

Bollinger Bands on the daily chart show a moderate decline: the price range is narrowing, reflecting mixed short-term trading sentiment. MACD indicates a weak upward movement, keeping a faint buy signal (the histogram remains above the signal line). In contrast, Stochastic maintains a steady downward bias, showing little reaction to the near-term bullish dynamics.

Resistance: 1.3450, 1.3500, 1.3554, 1.3600.

Support: 1.3413, 1.3364, 1.3300, 1.3250.

Trading Scenarios and GBP/USD Forecast

Trading Scenarios and GBP/USD Forecast

Short positions can be opened after a confident breakdown below 1.3413 with a target at 1.3300. Stop-loss — 1.3460. Implementation time: 2–3 days.

A continuation of the bullish momentum with a breakout above 1.3500 may serve as a signal to open new long positions with a target at 1.3600. Stop-loss — 1.3450.

Scenario

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3410 |

| Take Profit | 1.3300 |

| Stop Loss | 1.3460 |

| Key Levels | 1.3250, 1.3300, 1.3364, 1.3413, 1.3450, 1.3500, 1.3554, 1.3600 |

Alternative Scenario

| Recommendation | BUY STOP |

| Entry Point | 1.3500 |

| Take Profit | 1.3600 |

| Stop Loss | 1.3450 |

| Key Levels | 1.3250, 1.3300, 1.3364, 1.3413, 1.3450, 1.3500, 1.3554, 1.3600 |