In the third quarter, the UK’s gross domestic product (GDP) increased by 0.1% quarter-on-quarter and 1.3% year-on-year, in line with preliminary estimates. Investment volumes surprised to the upside, rising by 1.5% instead of the expected decline of 0.3%, and by 2.7% year-on-year versus 0.7% previously. These reports strengthened expectations of an economic recovery, boosting demand for the pound.

The British currency is also supported by the likelihood of a pause in the monetary easing cycle. In December, Bank of England officials cut the interest rate by 25 basis points to 3.75%, but signaled that further reductions would be difficult given persistently high inflation, which stood at 3.2% in November.

Meanwhile, markets expect the US Federal Reserve to maintain a dovish tone at the start of next year, although comments from policymakers remain cautious. November data confirmed further cooling in the US labor market, with the unemployment rate rising to 4.6%, while consumer inflation slowed to 2.7%, allowing the Fed to consider additional rate cuts in the near term.

Even strong US GDP figures failed to support the dollar. In the third quarter, annual growth accelerated to 4.3%, yet the US currency continued to weaken, reinforcing bullish sentiment in GBP/USD.

Support and Resistance Levels

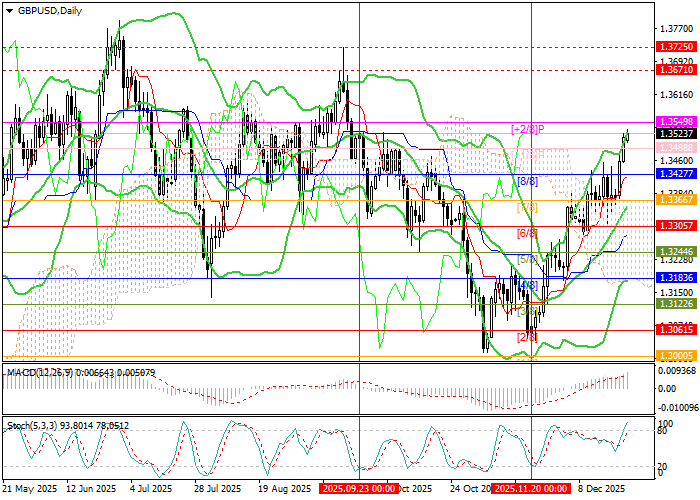

The instrument is approaching the 1.3549 level (Murray [+2/8]). A sustained move above this area could open the way toward 1.3671 (Murray [8/8], W1) and 1.3725 (September highs). Conversely, a break below 1.3305 (Murray [6/8]), beneath the midline of the Bollinger Bands, could trigger a decline toward 1.3183 (Murray [4/8]) and 1.3061 (Murray [2/8]).

Technical indicators point to a developing uptrend: Bollinger Bands are turning higher, the MACD histogram is expanding in positive territory, although the Stochastic oscillator entering overbought territory does not rule out a reversal or a limited corrective pullback.

Resistance levels: 1.3549, 1.3671, 1.3725.

Support levels: 1.3305, 1.3183, 1.3061.

Trading Scenarios and GBP/USD Forecast

Long positions can be considered after a firm break and consolidation above 1.3549, with targets at 1.3671 and 1.3725. Stop-loss: 1.3475. Time horizon: 5–7 days.

Short positions can be considered below 1.3305, with targets at 1.3183 and 1.3061. Stop-loss: 1.3390.

Scenario

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry point | 1.3550 |

| Take Profit | 1.3671, 1.3725 |

| Stop Loss | 1.3475 |

| Key levels | 1.3061, 1.3183, 1.3305, 1.3549, 1.3671, 1.3725 |

Alternative Scenario

| Recommendation | SELL STOP |

| Entry point | 1.3300 |

| Take Profit | 1.3183, 1.3061 |

| Stop Loss | 1.3390 |

| Key levels | 1.3061, 1.3183, 1.3305, 1.3549, 1.3671, 1.3725 |