Investors’ attention is focused on Japan’s prime minister elections in the lower house of parliament, scheduled for today. Earlier, the Liberal Democratic Party (LDP) reached an agreement to form a coalition with the Japan Renewal Society, securing the necessary majority to elect LDP leader Sanae Takaichi as prime minister. She is expected to pursue a more protectionist policy, which may complicate further monetary tightening by the Bank of Japan.

On Wednesday at 01:50 (GMT+2), Japan will release September trade data. Forecasts suggest exports will rise by 4.6% after a –0.1% decline in the previous month, while imports are expected to increase by 0.6% after –5.2%, leading to a trade surplus of 22.0 billion yen compared to a –242.5 billion yen deficit last month.

Meanwhile, the U.S. dollar remains under pressure from the ongoing government shutdown. Yesterday, the Senate failed for the eleventh consecutive time to pass the stopgap funding bill previously approved by the House of Representatives — only 50 senators voted in favor, while at least 60 votes were needed for approval.

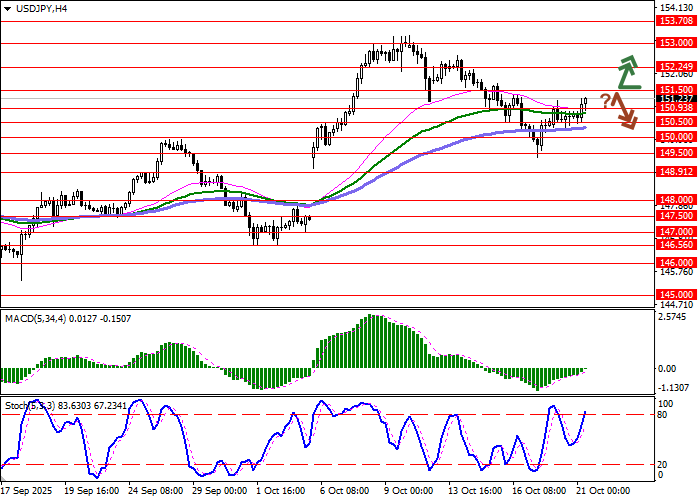

Support and Resistance Levels

Bollinger Bands on the daily chart show steady growth: the price range is actively narrowing but remains wide enough for the current level of market activity. MACD is turning upward, preparing to generate a new buy signal (the histogram is moving above the signal line). Stochastic shows more confident growth and is currently positioned around the middle of its working range.

Resistance levels: 151.50, 152.24, 153.00, 153.70.

Support levels: 150.93, 150.50, 150.00, 149.50.

Trading Scenarios and USD/JPY Forecast

Long positions may be opened after a confident breakout above 151.50, targeting 152.50. Stop-loss — 150.93. Estimated timeframe: 1–2 days.

A rebound from 151.50 as resistance followed by a decline below 150.93 could signal new short positions targeting 150.00. Stop-loss — 151.50.

Scenario

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 151.55 |

| Take Profit | 152.50 |

| Stop Loss | 150.93 |

| Key Levels | 149.50, 150.00, 150.50, 150.93, 151.50, 152.24, 153.00, 153.70 |

Alternative Scenario

| Recommendation | SELL STOP |

| Entry Point | 150.90 |

| Take Profit | 150.00 |

| Stop Loss | 151.50 |

| Key Levels | 149.50, 150.00, 150.50, 150.93, 151.50, 152.24, 153.00, 153.70 |