Bitcoin ETF Outflows

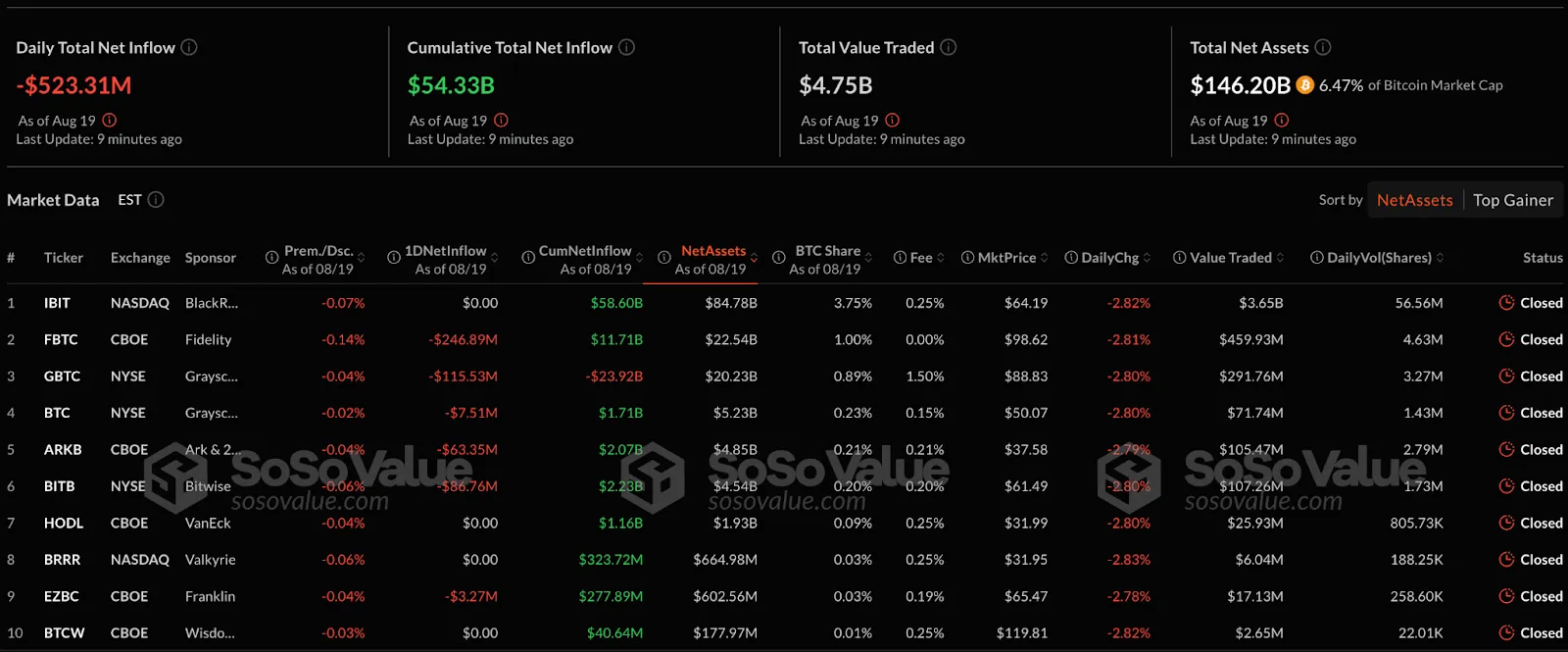

Bitcoin ETFs saw $523 million pulled in a single day. The largest redemptions came from Fidelity ($246.9M) and Grayscale ($115.53M). BlackRock’s IBIT fund remained flat with no net changes.

Ethereum ETF Outflows

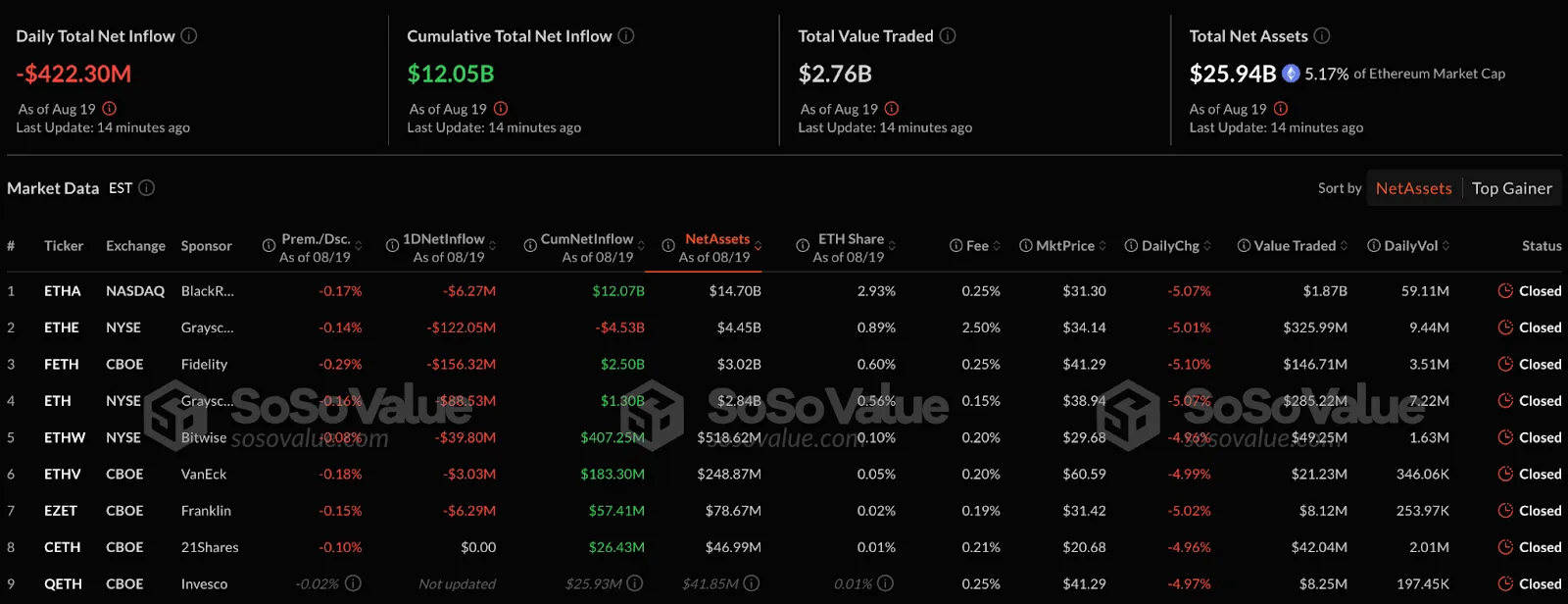

Ethereum ETFs lost $422 million — the second-largest daily outflow since their launch. Fidelity funds accounted for $156.32M in redemptions, while Grayscale saw $122M. Other issuers reported smaller losses.

Institutional Positioning and Macro Outlook

Lucas noted the scale of outflows signals institutional repositioning. Investors could be locking in profits near recent highs and reallocating into cash or Treasuries, or broadly reducing risk exposure amid concerns about inflation, dollar strength, and Fed policy uncertainty.

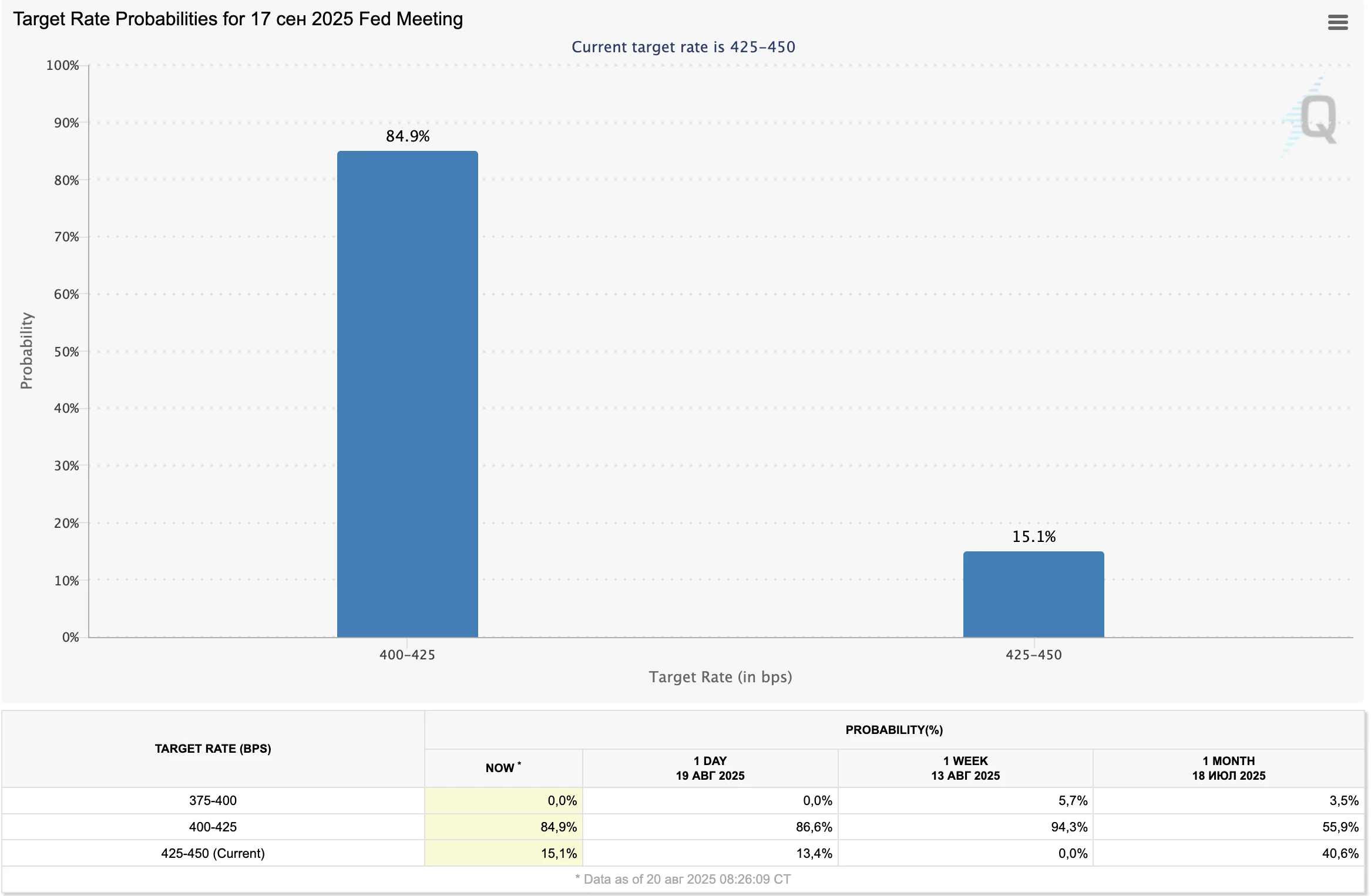

According to CME FedWatch, 84.9% of traders expect a rate cut at the next Fed meeting, while 15.1% see rates unchanged.

Impact on Crypto Prices

The ETF outflows coincided with price declines: Bitcoin slipped 1% to below $114,000, while Ethereum fell 0.7% to $4,208. Investors are now focused on Fed Chair Jerome Powell’s speech at Jackson Hole on August 21, which Lucas suggested could act as the next major market catalyst.

ETF Market Share Shift

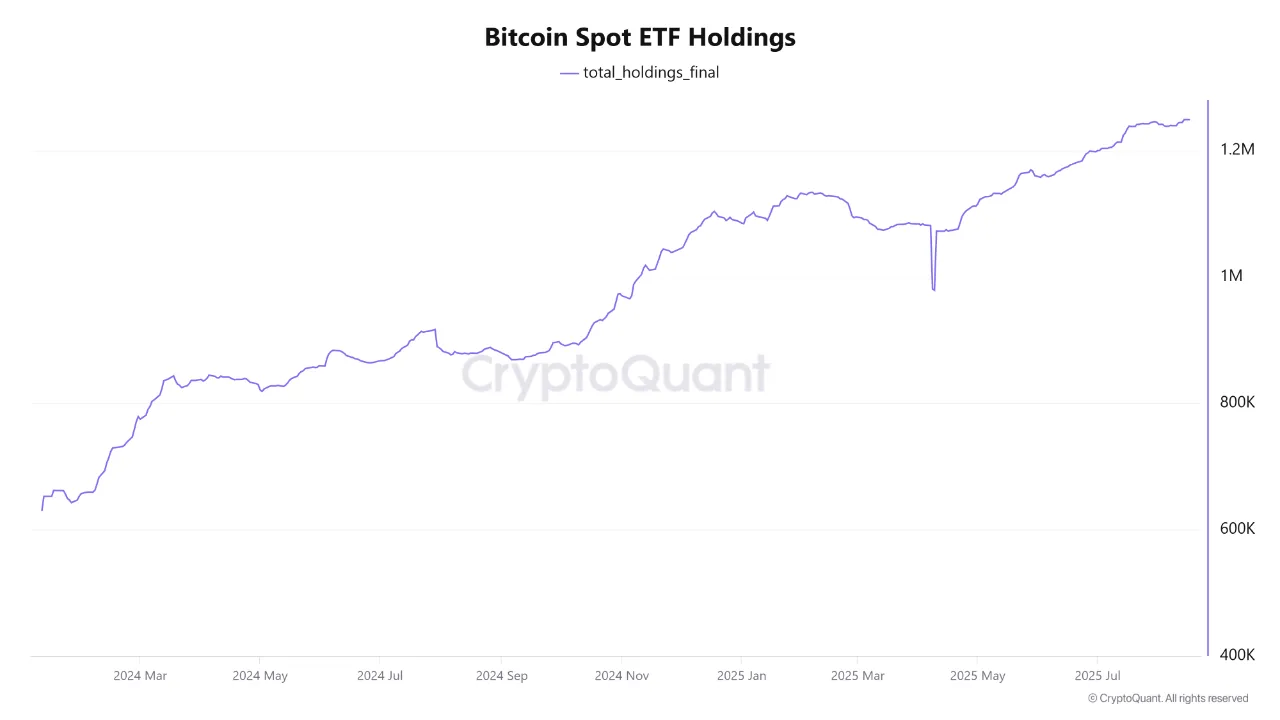

CryptoQuant analyst CryptoOnchain highlighted that Bitcoin ETFs now collectively hold over 1.2 million BTC — a record level of institutional exposure. BlackRock leads with 748,968 BTC under management, while Fidelity and BlackRock together control over 75% of ETF-based Bitcoin.

Grayscale, once the dominant player with over 620,000 BTC, now holds just 180,576 BTC. “The era of one-fund dominance is over,” noted the analyst

Reminder: Earlier, the FORECK.INFO editorial team covered how record ETH shorts on CME could set the stage for a sharp move — either a crash or a short squeeze. Read more →