On the previous day, the regulator left interest rates unchanged for the fourth consecutive meeting and presented a broadly positive outlook for the coming periods. The deposit facility rate stands at 2.00%, the marginal lending rate at 2.40%, and the main refinancing rate at 2.15%. During the subsequent press conference, ECB President Christine Lagarde highlighted positive dynamics across most segments of the economy, with the services sector—particularly information technology—remaining the dominant growth driver. She noted a rise in investment activity, including technology projects involving artificial intelligence, and stressed that policymakers are prepared to use all available tools to preserve price stability if necessary. According to Lagarde, domestic consumer demand is expected to remain the key engine of economic growth in the coming years, while external trade conditions continue to act as a constraint.

At the same time, Lagarde once again refrained from giving explicit guidance on the future direction of monetary policy, citing a high degree of uncertainty. Economists expect average inflation in 2026–2027 to remain close to the ECB’s 2.0% target, largely due to deflationary pressures in the energy sector. Economic growth projections are also seen as stable, with GDP expected to rise by around 0.3% following a similar increase recorded in the third quarter.

Meanwhile, the US dollar is maintaining an upward trend, with the USD Index trading near 98.10. Initial jobless claims declined from 237,000 to 224,000, in line with expectations, while continuing claims rose from 1.830 million to 1.897 million, below the forecast of 1.930 million. Analysts attribute this dynamic primarily to large-scale layoffs in the public sector, as around 250,000 government employees accepted a voluntary separation program and left their positions by October 1.

Support and resistance levels

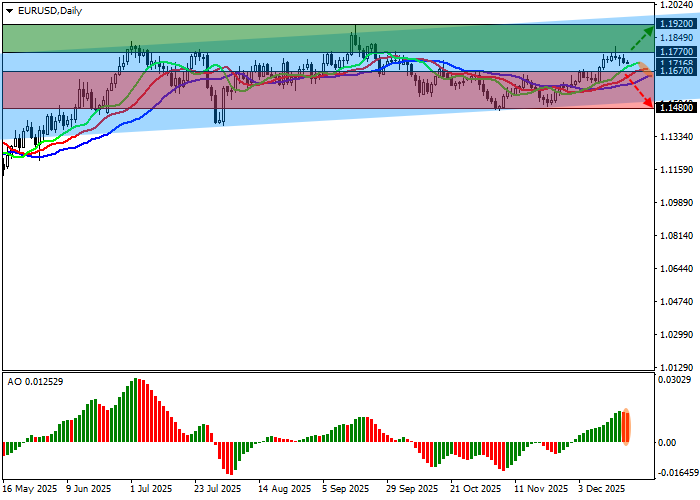

On the daily chart, the pair is approaching the resistance line of an ascending channel with boundaries at 1.2000–1.1500.

Technical indicators are maintaining an unstable buy signal: the fast EMAs of the Alligator indicator remain slightly above the signal line and are widening their range, while the AO histogram is forming corrective bars and continues to rise in positive territory.

Resistance levels: 1.1770, 1.1920.

Support levels: 1.1670, 1.1480.

Trading scenarios and EUR/USD forecast

Long positions may be considered after a sustained move above 1.1770, with a target near 1.1920 and a stop-loss at 1.1700. Time horizon: 7 days or more.

Short positions may be considered after a sustained move below 1.1670, targeting 1.1480, with a stop-loss near 1.1730.

Scenario

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry point | 1.1775 |

| Take Profit | 1.1920 |

| Stop Loss | 1.1700 |

| Key levels | 1.1480, 1.1670, 1.1770, 1.1920 |

Alternative scenario

| Recommendation | SELL STOP |

| Entry point | 1.1665 |

| Take Profit | 1.1480 |

| Stop Loss | 1.1730 |

| Key levels | 1.1480, 1.1670, 1.1770, 1.1920 |