Last week’s negative trend was driven by weak U.S. data: in September, the University of Michigan’s consumer expectations index fell from 55.9 to 51.8, versus a forecast of 54.9, while consumer sentiment dropped from 58.2 to 55.4 against an expected 58.2. At the same time, initial jobless claims rose to 263,000, compared to expectations of 235,000.

Meanwhile, in Q3 Japan’s Large Manufacturers’ Business Conditions Index improved from –4.8 to 3.8, beating preliminary estimates of –3.3. GDP in Q2 also came in stronger, rising from 0.1% to 0.5% versus a forecast of 0.3%. In July, industrial production printed at –1.2% month-over-month, better than the –1.6% expected. Based on this data, the Bank of Japan may keep rates unchanged at 0.50% at its next meeting, and if the economy continues to recover, could even consider tightening monetary policy — a factor supportive for the yen.

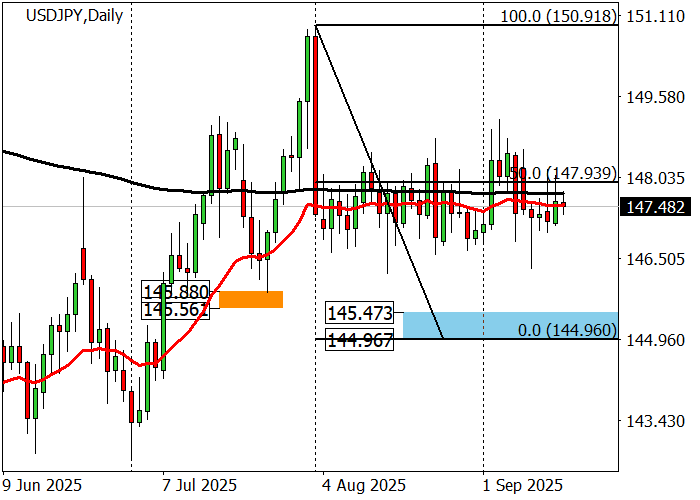

Support and Resistance Levels

The long-term trend remains bearish: price is holding below the 148.85 threshold, maintaining downside potential toward 146.33 and 142.50. However, a breakout above resistance at 148.85 could shift momentum and trigger a retest of the August high at 150.70.

The medium-term trend is bullish toward zone 2 (152.14–151.59), but prices are currently correcting and may test the trend support zone at 145.47–144.96. A bounce here would open the way for long positions targeting 147.93 and 150.91.

Resistance levels: 148.85, 150.70, 154.80.

Support levels: 146.33, 142.50, 140.25.

Trading Scenarios and USD/JPY Forecast

Short positions may be considered from 148.85 with a target at 146.33 and stop-loss at 149.88. Implementation horizon: 9–12 days.

Long positions may be opened above 149.88 with a target at 152.90 and stop-loss at 148.41.

Scenario

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 148.85 |

| Take Profit | 146.33 |

| Stop Loss | 149.88 |

| Key Levels | 140.25, 142.50, 146.33, 148.85, 150.70, 154.80 |

Alternative Scenario

| Recommendation | BUY STOP |

| Entry Point | 149.90 |

| Take Profit | 152.90 |

| Stop Loss | 148.41 |

| Key Levels | 140.25, 142.50, 146.33, 148.85, 150.70, 154.80 |