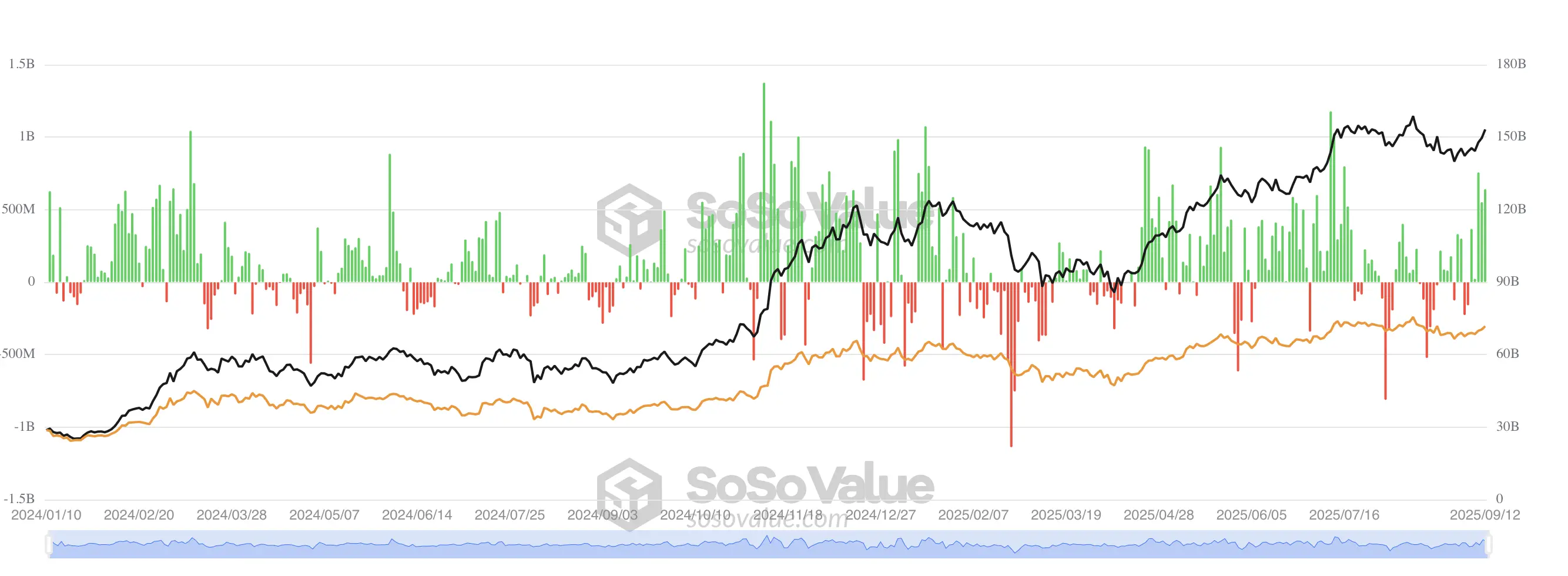

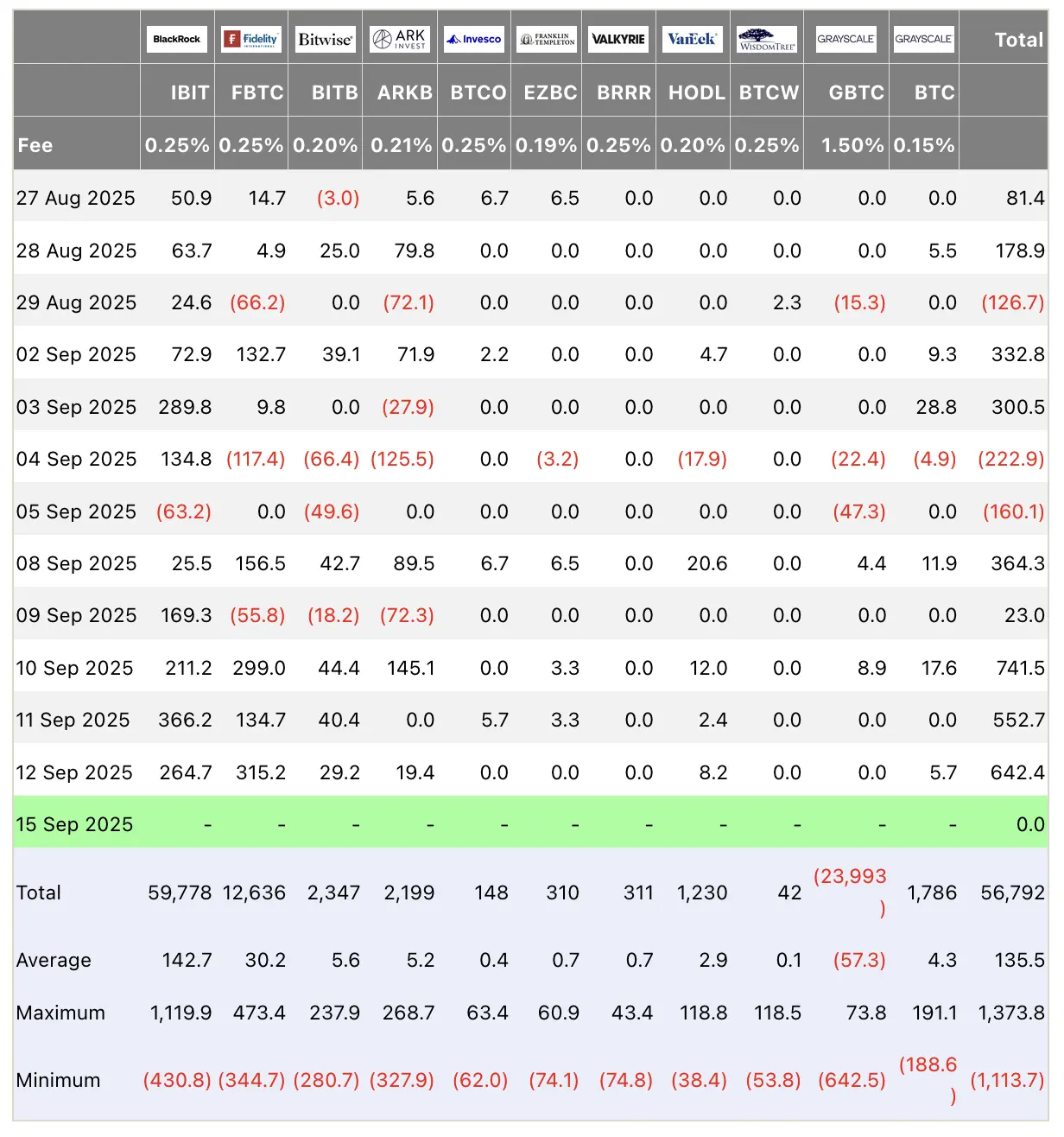

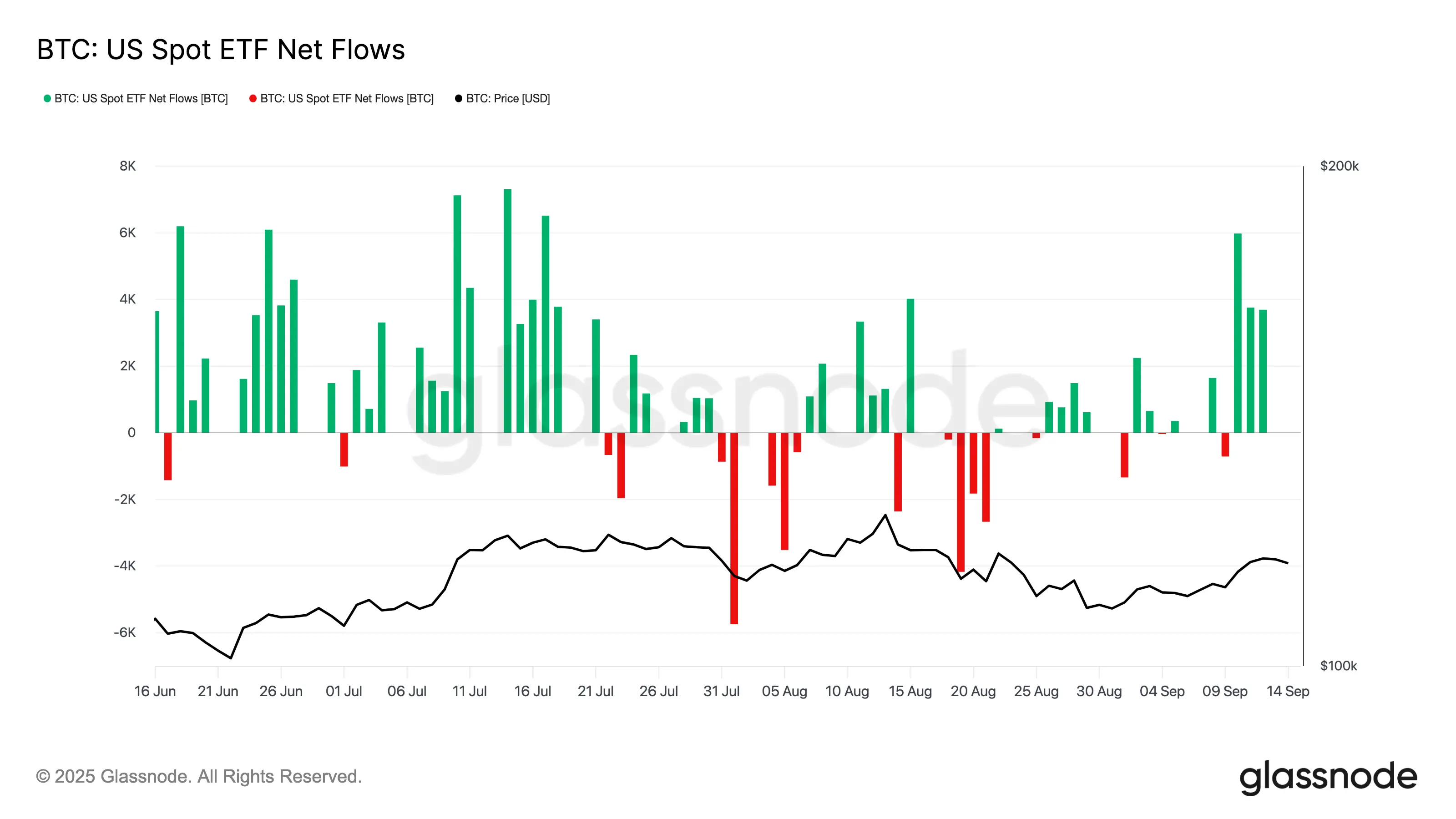

Bitcoin ETFs are seeing a strong revival. After slowing in August, funds from giants like BlackRock, Fidelity, and Bitwise have bounced back with force.

In the past week alone, inflows reached $2.34 billion. On Friday, September 12, net inflows totaled $642 million, according to SoSoValue and Farside Investors.

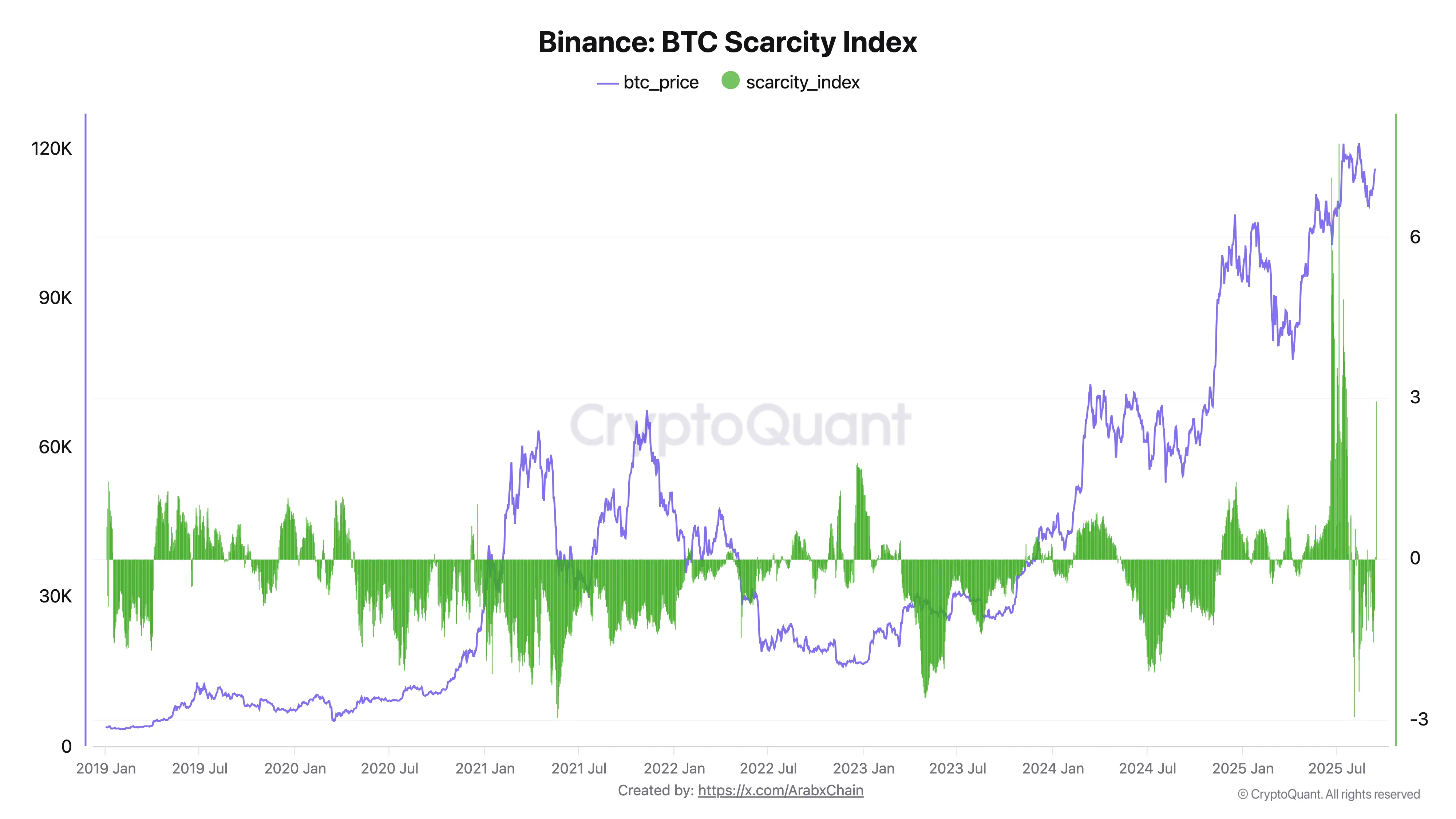

Binance Hints at Bitcoin Supply Squeeze, Fueling Bullish Sentiment

The world’s largest crypto exchange, Binance, has hinted at a potential tightening of BTC supply — a factor that could energize bullish momentum. According to fresh analysis from on-chain research firm CryptoQuant, a major buyer may have been active on Binance over the weekend. Community member Arab Chain pointed to the platform’s Binance Scarcity Index as evidence of this activity.

The index tends to surge when short-term buying pressure outweighs the available supply — almost like a rush of investors competing to secure Bitcoin,” CryptoQuant noted in a Quicktake post. “Such spikes are usually triggered by bullish headlines or sudden inflows of capital. A similar setup was observed last June and lasted several days, ultimately pushing Bitcoin toward the $124,000 mark.

These inflows far outstrip Bitcoin’s new supply from mining. As Bitwise’s Head of Research in Europe, Dr. André Dragosch, highlighted on X:

“Over the last five trading days, Bitcoin ETF inflows exceeded new issuance by nearly 9x.”

🔴NOTE: Over the latest 5 trading days, flows into #bitcoin ETFs have surpassed new supply by

— André Dragosch, PhD⚡ (@Andre_Dragosch) September 15, 2025

*checks notes*

8.93 x times.

Probably nothing. pic.twitter.com/yT4hvgsCqg

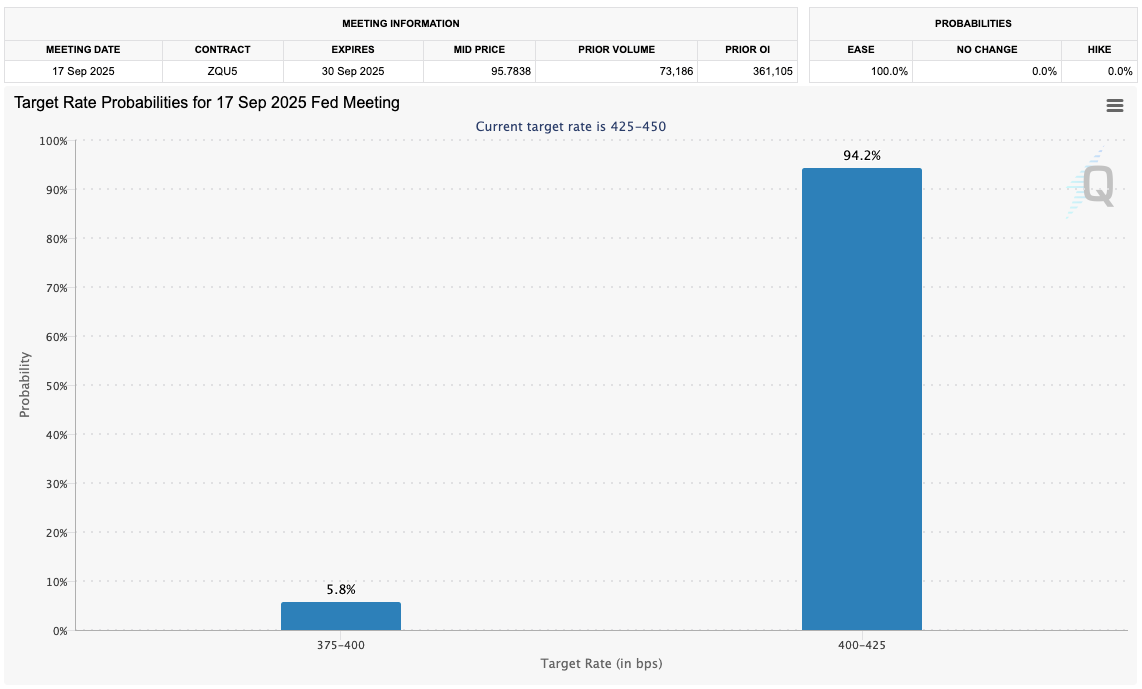

The broader crypto market is rallying ahead of the Fed meeting, with most investors betting that Chair Jerome Powell will announce a 25-basis-point rate cut on Wednesday, September 17 — a move that could add further fuel to risk assets

On-chain analytics provider Glassnode reported that on September 10 alone, Bitcoin ETFs recorded inflows of 5,900 BTC — their biggest single-day intake since mid-July.

“This surge turned weekly net flows back into positive territory, highlighting renewed demand for ETFs as Bitcoin holds above the $114,000 level,” the firm noted.