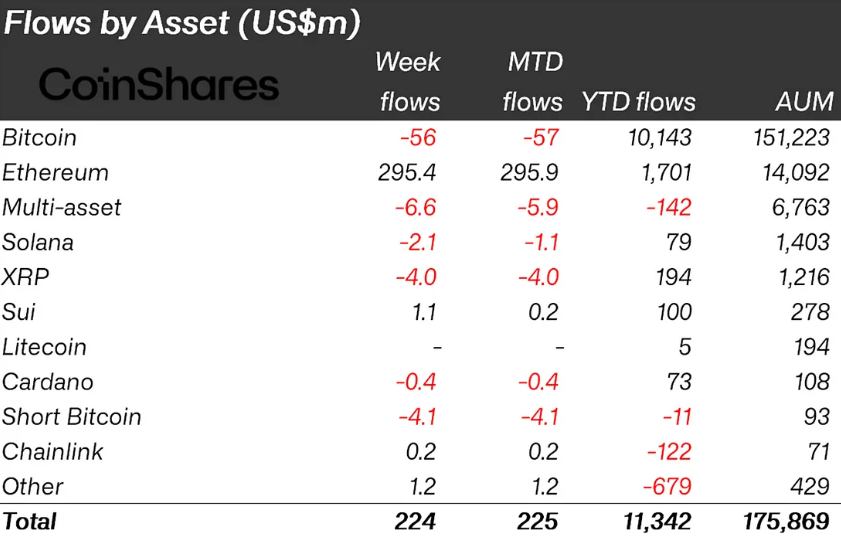

Ethereum Leads Inflows, Bitcoin Funds See Further Outflows

Between June 2 and 6, 2025, net capital inflows into crypto funds dropped to their lowest in several weeks. Ethereum-based products were the standout, attracting $295.4 million—the highest among all digital assets. In contrast, bitcoin products saw a second consecutive week of outflows, totaling –$56.5 million.

Ethereum tops inflows as Bitcoin funds see continued outflows. CoinShares.

Ethereum tops inflows as Bitcoin funds see continued outflows. CoinShares. The CoinShares report notes that this pattern reflects a cautious mood among investors, with many waiting for signals from the Fed’s rate meeting on June 18–19.

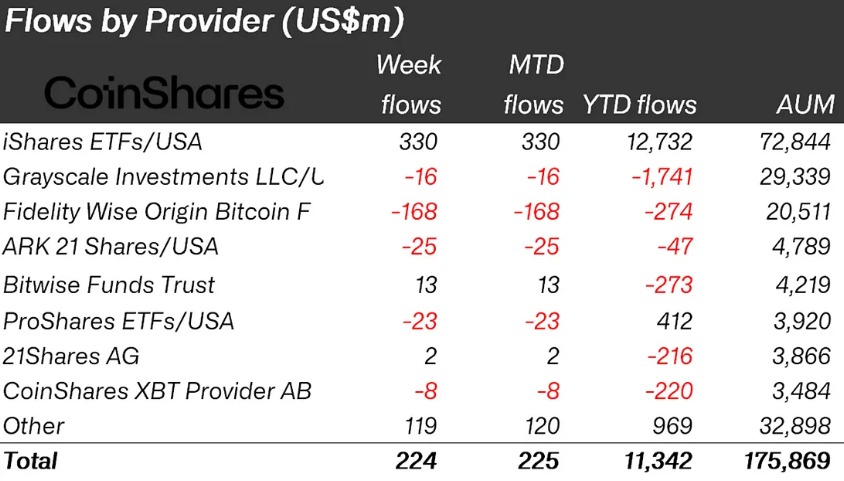

iShares Dominates Providers, US Remains Market Leader

By provider, iShares maintained its leadership, attracting $330 million over the week. Other firms with positive flows included Bitwise and 21Shares, while the rest experienced net outflows.

iShares leads with strong weekly inflows, Bitwise and 21Shares also up. CoinShares.

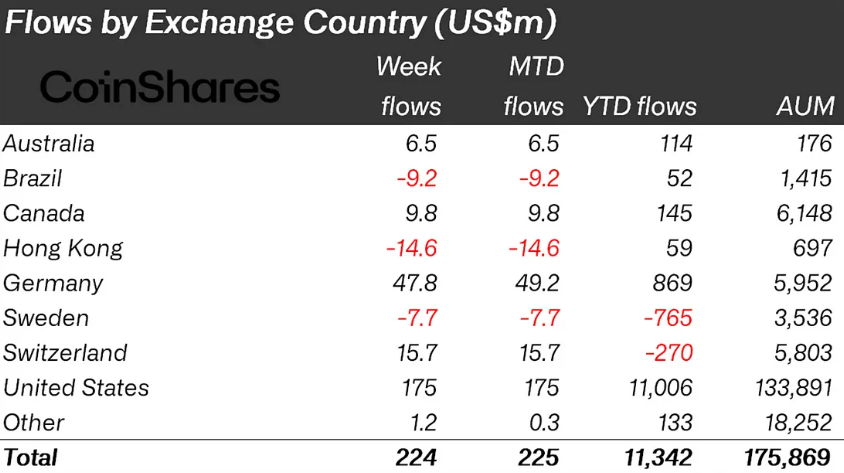

iShares leads with strong weekly inflows, Bitwise and 21Shares also up. CoinShares. Geographically, the United States remains the dominant market, posting $175 million in inflows. Germany, Switzerland, Canada, and Australia followed. Minor outflows were observed in Brazil and Hong Kong, the latter ending a record streak of positive flows.

US continues to dominate crypto fund inflows; Hong Kong streak ends. CoinShares.

US continues to dominate crypto fund inflows; Hong Kong streak ends. CoinShares. Outlook: Investors Take a Wait-and-See Approach

CoinShares analysts attribute the shift to a widespread “wait-and-see” stance ahead of the next Fed meeting. The US central bank’s last decision left rates unchanged, which previously triggered a rally in bitcoin. According to CME forecasts, traders expect the Fed to keep its current policy at the June 18–19 meeting as well.