Earlier this week, U.S. Treasury Secretary Scott Bessent wrote on X that the willingness of Japan’s new government under Sanae Takaichi to grant the Bank of Japan flexibility in interest rate policy will be crucial in preventing excessive currency volatility. Analysts note that narrowing the rate gap could benefit U.S. exporters, although Prime Minister Takaichi continues to favor a dovish stance. The Bank of Japan meeting is scheduled for 05:00 (GMT+2) tomorrow, where policymakers are expected to keep rates at 0.50%, while markets focus on guidance regarding future meetings later this year and early next year.

The U.S. dollar is recovering, with the USDX index trading at 98.60 despite the ongoing fourth week of the government shutdown. The rebound is supported by a stronger-than-expected Conference Board consumer confidence index, which rose to 94.6 points versus forecasts of 93.4. Later today at 20:00 (GMT+2), the Federal Reserve will announce its policy decision, and traders broadly expect another 25 basis-point rate cut, bringing the cumulative reduction since September to 1.00%.

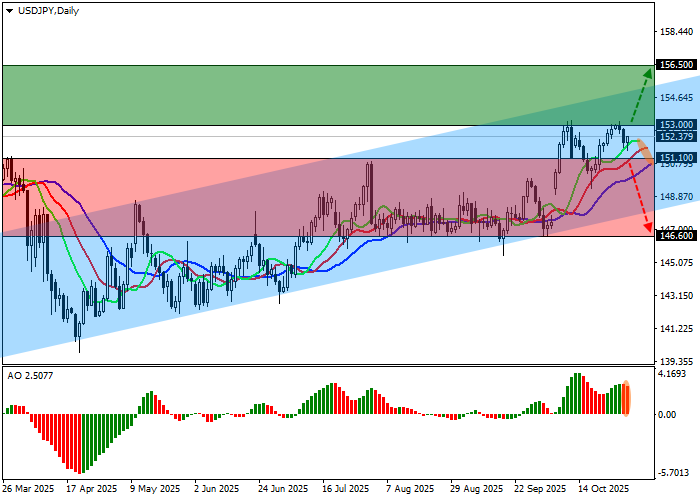

Support and Resistance Levels

On the daily chart, USD/JPY is correcting within an uptrend, approaching the upper boundary of the ascending channel between 155.00 and 148.50.

Technical indicators maintain a buy signal: the Alligator’s fast EMAs remain above the signal line, while the Awesome Oscillator (AO) histogram forms corrective bars in the positive zone.

Resistance levels: 153.00, 156.50.

Support levels: 151.10, 146.60.

USD/JPY Trading Scenarios and Forecast

Long positions can be opened after a breakout above 153.00 with a target at 156.50 and a stop loss at 152.00. Time frame: 7 days or more.

Short positions can be considered after a decline below 151.10 with a target at 146.60 and a stop loss at 153.00.

Scenario

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 153.05 |

| Take Profit | 156.50 |

| Stop Loss | 152.00 |

| Key Levels | 146.60, 151.10, 153.00, 156.50 |

Alternative Scenario

| Recommendation | SELL STOP |

| Entry Point | 151.05 |

| Take Profit | 146.60 |

| Stop Loss | 153.00 |

| Key Levels | 146.60, 151.10, 153.00, 156.50 |